These informed decisions help in maximizing productivity and profitability. Let’s go through all the steps for calculating total manufacturing costs. Now that you are familiar with the components that constitute manufacturing costs, let’s move on to the process of calculating these expenses.

The Difference Between Manufacturing and Nonmanufacturing Costs

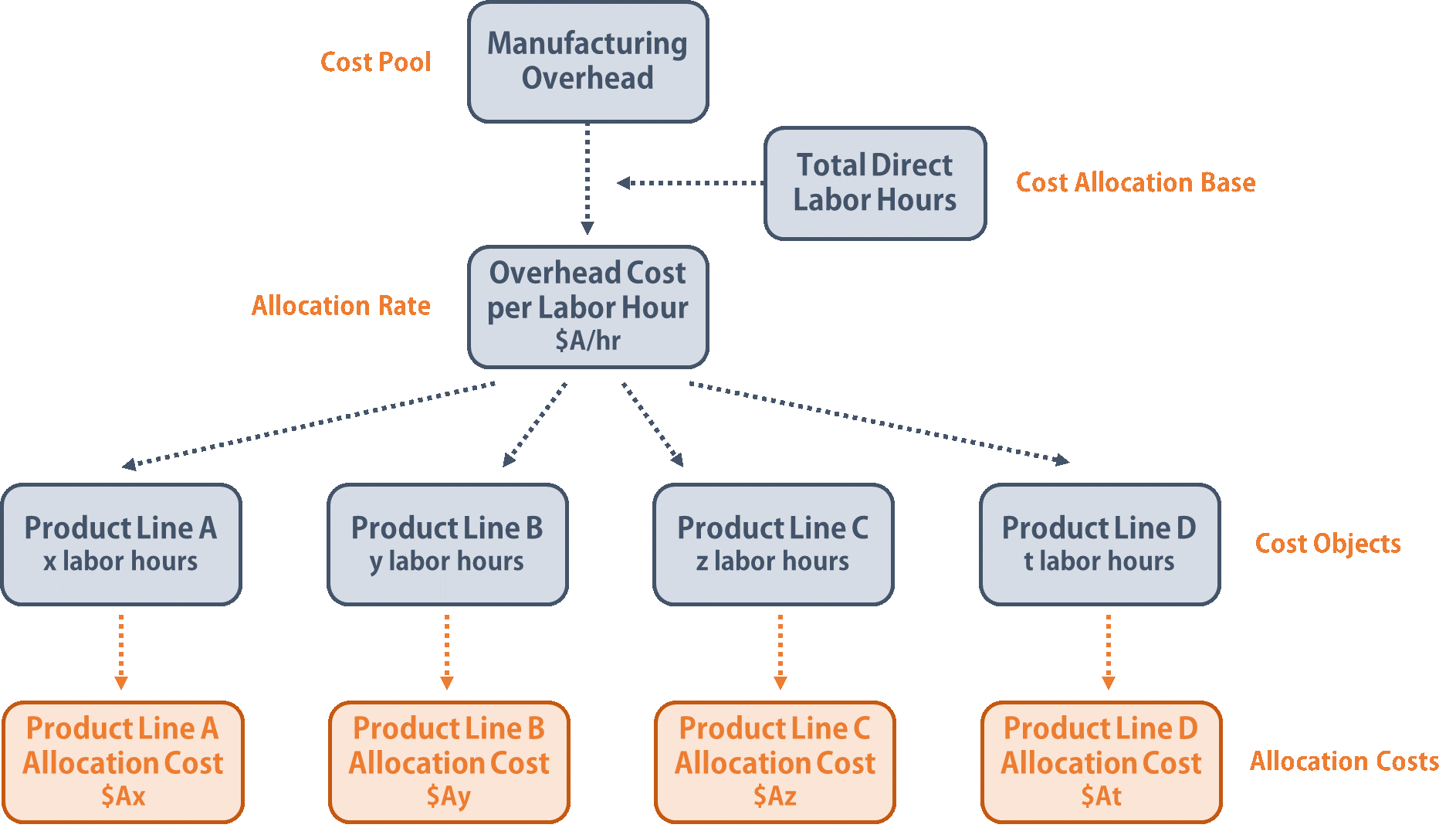

By looking at the historic data on employee timesheets and purchasing costs, the firm was able to understand the areas that were increasing the total manufacturing costs. Direct labor costs include the wages and benefits paid to employees directly involved in the production process of goods or products. Be sure to allocate overhead costs to the respective cost centers (specific departments, processes, or machines in the manufacturing facility that contribute to the manufacturing costs).

Top 5 Career Options for Accounting Graduates

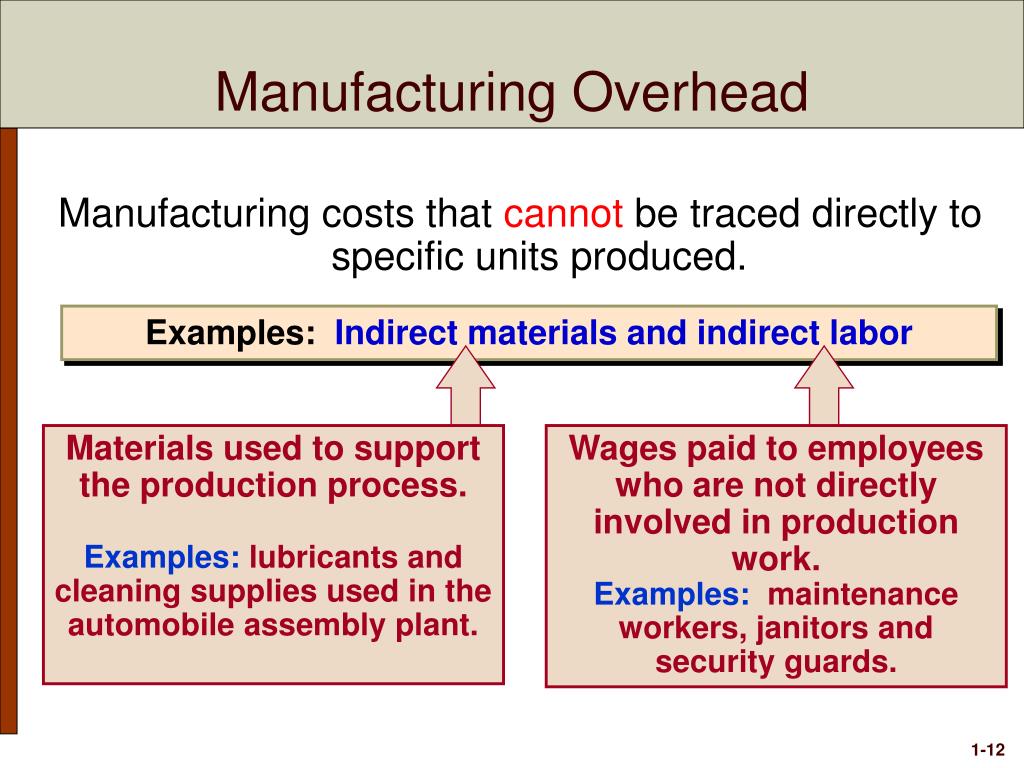

All other manufacturing costs are classified as manufacturing overhead. All nonmanufacturing costs are not related to production and are classified as either selling costs or general and administrative costs. Manufacturing overhead are costs that are not part of labor or material cost and can be either a fixed or variable cost. For instance, fixed overhead costs consist of property taxes, insurance premiums, depreciation and nonmanufacturing employee salaries, according to Accounting Tools. Whereas, variable direct manufacturing overhead costs include indirect labor, indirect material and utilities. Though most of these costs are self-evident, indirect material costs are unique because these costs are not essential to the physical production of the product.

Examples

- The wood used to build tables and the hardware used to attach table legs would be considered direct materials.

- Manufacturing costs, also called product costs, are the expenses a company incurs in the process of manufacturing products.

- (Product costs only include direct material, direct labor, and manufacturing overhead.) Nonmanufacturing costs are reported on a company’s income statement as expenses in the accounting period in which they are incurred.

- Kavitha Simha is a productivity author and researcher, passionate about finding smarter ways to manage time.

This is important because while climate costs of energy can be reduced by switching to renewable sources, process costs are fixed unless we can develop new processes or substitute materials. For example, manufacturing aluminum generates quite a lot of carbon dioxide per weight of product, while making the same amount of brick generates much less. But the tonnage of bricks produced every year is far higher than that of aluminum, so making bricks contributes more to climate costs overall than making aluminum. Table 2.3.1 provides several examples of manufacturing costs at Custom Furniture Company by category.

In other words, selling prices must be large enough to cover SG&A expenses, interest expense, manufacturing overhead, direct labor, direct materials, and profit. Factory overhead – also called manufacturing overhead, refers to all costs other than direct materials and direct labor spent in the production of finished goods. All manufacturing costs that are easily traceable to a product are classified as either direct materials or direct labor.

Manufacturing Overhead

Unlike relevant costs, they do not have an impact on the matter at hand. Relevant cost – cost that will differ under alternative courses of action. In other words, these costs refer to those that will affect a decision. A word used how to open a business bank account online by accountants to communicate that an expense has occurred and needs to be recognized on the income statement even though no payment was made. The second part of the necessary entry will be a credit to a liability account.

This account is a non-operating or “other” expense for the cost of borrowed money or other credit. It is likely that you will have to estimate the cost of these activities. Next, you will need to allocate the cost of the activities to the individual products.

However, as we noted earlier, managerial accounting information is tailored to meet the needs of the users and need not follow U.S. They form part of inventory and are charged against revenue, i.e. cost of sales, only when sold. All manufacturing costs (direct materials, direct labor, and factory overhead) are product costs. Nonmanufacturing overhead costs are the business expenses that are outside of a company’s manufacturing operations. In other words, these costs are not part of a manufacturer’s product cost or its production costs (which are direct materials, direct labor, and manufacturing overhead).