The equity capital/stockholders’ equity can also be viewed as a company’s net assets. You can calculate this by subtracting the total assets from the total liabilities. Shareholders’ equity, often referred to as stockholders’ equity, is a crucial financial metric in accounting, representing the residual interest in the assets of a corporation after deducting its liabilities. It provides a snapshot of a company’s financial health and stability, crucial for investors, creditors, and the company’s management. By comparing total equity to total assets belonging to a company, the shareholders equity ratio is thus a measure of the proportion of a company’s asset base financed via equity. It is calculated by subtracting the total liabilities from the total assets.

What is the approximate value of your cash savings and other investments?

There is a clear distinction between the book value of equity recorded on the balance sheet and the market value of equity according to the publicly traded stock market. The shareholders equity ratio, or “equity ratio”, is a method to ensure the amount of leverage used to fund the operations of a company is reasonable. The “Treasury free invoice samples and templates for every business Stock” line item refers to shares previously issued by the company that were later repurchased in the open market or directly from shareholders. Under a hypothetical liquidation scenario in which all liabilities are cleared off its books, the residual value that remains reflects the concept of shareholders equity.

- Retained earnings are typically reinvested back into the business either through the payment of debt, to purchase assets, or to fund daily operations.

- Stockholders’ equity is also referred to as shareholders’ or owners’ equity.

- To compute total liabilities for this equity formula, add the current liabilities such as accounts payable and short-term debts and long-term liabilities such as bonds payable and notes.

Book Value of Equity vs. Market Value of Equity: What is the Difference?

Over the years, shareholders’ equity has become a fundamental component of a company’s balance sheet, offering insight into its financial well-being. Since repurchased shares can no longer trade in the markets, treasury stock must be deducted from shareholders’ equity. Enter the value of all assets and liabilities owned by shareholders to determine the shareholder’s equity. Negative shareholders’ equity suggests that the company might want to consider reducing its liabilities or finding ways to boost its profits.

Everything You Need To Master Financial Modeling

Current liabilities are debts typically due for repayment within one year, including accounts payable and taxes payable. Long-term liabilities are obligations that are due for repayment in periods longer than one year, such as bonds payable, leases, and pension obligations. In our modeling exercise, we’ll forecast the shareholders’ equity balance of a hypothetical company for fiscal years 2021 and 2022.

To compute total liabilities for this equity formula, add the current liabilities such as accounts payable and short-term debts and long-term liabilities such as bonds payable and notes. The company has sufficient assets to cover its liabilities if it’s in positive territory. Its liabilities exceed assets if it’s negative and this can deter investors who view such companies as risky. Shareholders’ equity isn’t the sole indicator of a company’s financial health, however. It should be paired with other metrics to obtain a more holistic picture of an organization’s standing.

Relevance and Uses of Shareholder’s Equity

If a company’s shareholder equity remains negative, it is considered to be balance sheet insolvency. The stockholders’ equity is only applicable to corporations who sell shares on the stock market. For sole traders and partnerships, the corresponding concepts are the owner’s equity and partners’ equity.

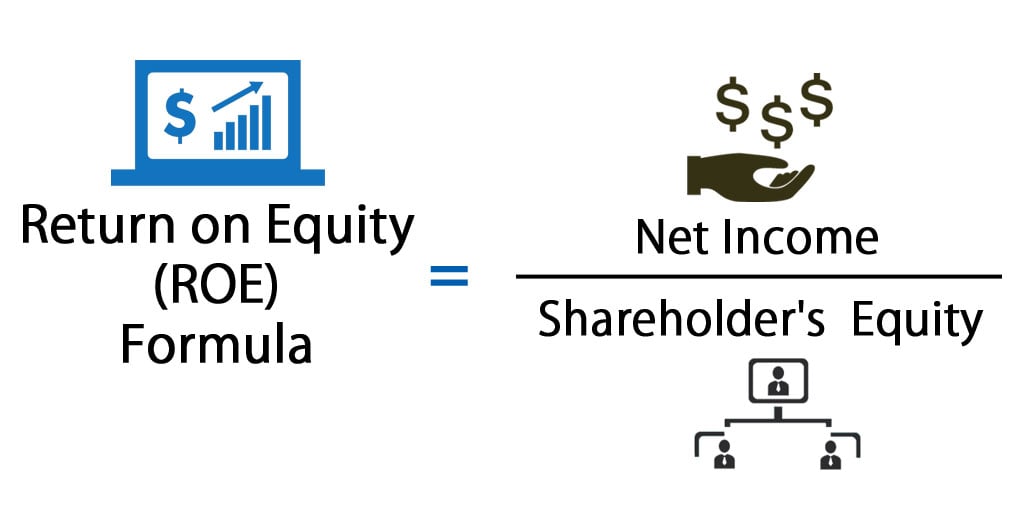

It is a financial metrics used to analyze the financial health of the company. Here is an online Shareholder funds calculator to calculate shareholder equity funds based on the total assets and total liabilities. This Shareholders equity calculator subtracts the total amount of liabilities on a company’s balance sheet from the total asset of the company and gives output. Two common ways to calculate the cost of equity are the capital asset pricing model (CAPM) and the dividend capitalization model (DCM).

Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master’s in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem. As for the “Treasury Stock” line item, the roll-forward calculation consists of one single outflow – the repurchases made in the current period. Here, we’ll assume $25,000 in new equity was raised from issuing 1,000 shares at $25.00 per share, but at a par value of $1.00.

As referred above, stockholders’ equity can be calculated by taking the total assets of a company and subtracting liabilities. Treasury shares continue to count as issued shares, but they are not considered to be outstanding and are thus not included in dividends or the calculation of earnings per share (EPS). Treasury shares can always be reissued back to stockholders for purchase when companies need to raise more capital. If a company doesn’t wish to hang on to the shares for future financing, it can choose to retire the shares.