However, there is always the chance that something gets misreported—like if you’re paying with petty cash and don’t record a $5 purchase. Of course, your general ledger’s appearance will ultimately depend on your personal preference and choice of software. For example, it may also contain details like a reference number or activity type for each transaction. Double Entry Bookkeeping is here to provide you with free online information to help you learn and understand bookkeeping and introductory accounting. As the business grows and the number of accounting staff increases it is impractical to have only one ledger.

Top Free Accounting & Bookkeeping Software Apps for 2022

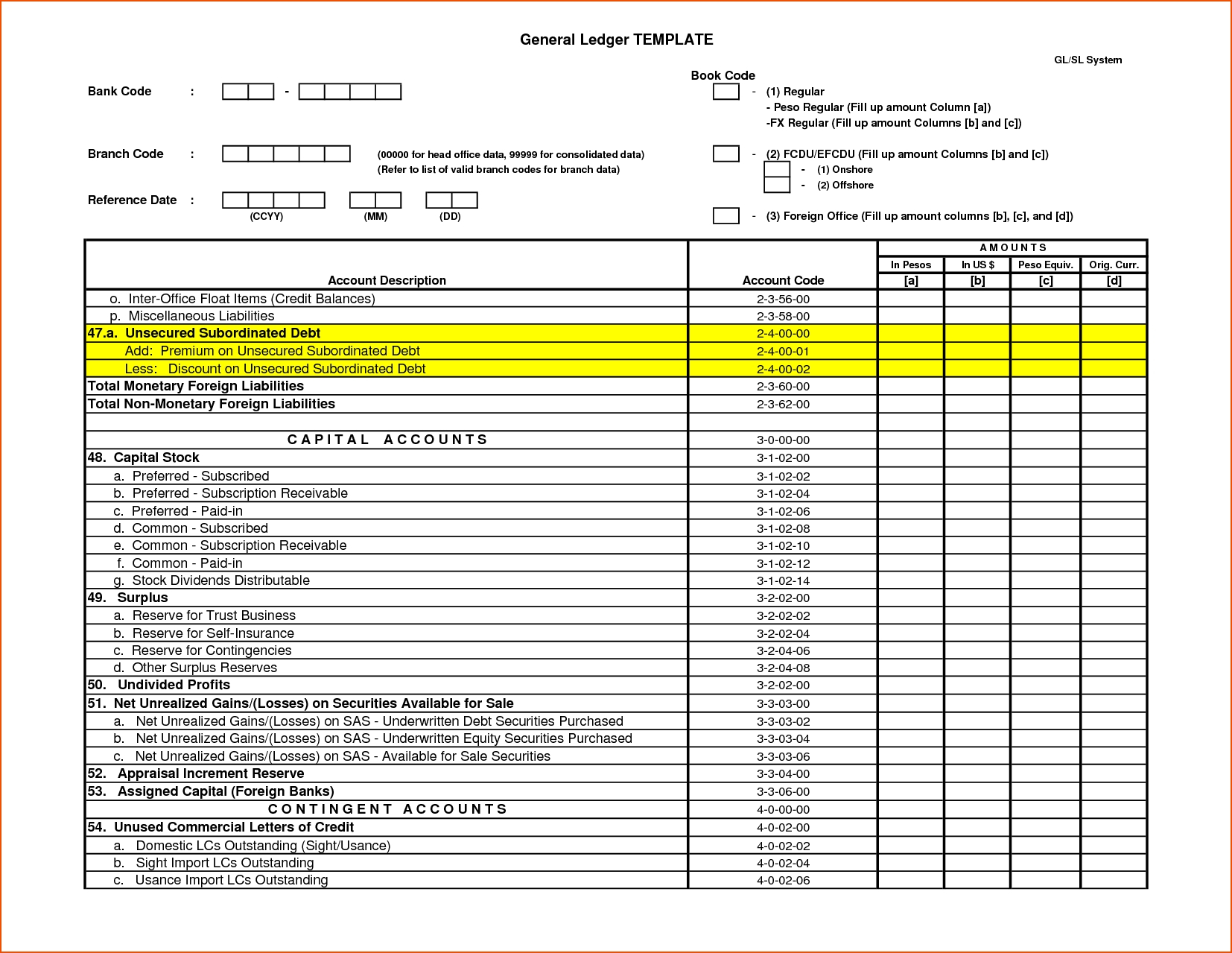

In this guide, we’ll provide you with an introduction to where general ledgers fit into small business accounting. Specify the ledger for the selected data access set.Ledger is required for all general ledger reports. Enter the data access set that you can access basedon the defined security structure. Since the general ledger is an overview of every financial transaction, it is easy to see every entry made and identify unusual activity. With the help of a general ledger, you can better track and evaluate every transaction for your business.

What’s the difference between a journal entry and a general ledger?

This system of debit and credit helps in finding out the final position of every item at the end of the given accounting period. The double-entry bookkeeping method ensures that the general ledger of a business is always in balance — the way you might maintain your personal checkbook. Every entry of a financial transaction within account ledgers debits one account and credits another in the equal amount.

How a General Ledger Works With Double-Entry Accounting Along With Examples

He has worked as an accountant and consultant for more than 25 years and has built financial models for all types of industries. He has been the CFO or controller of both small and medium sized companies and has run small businesses of his own. He has been a manager and an auditor with Deloitte, a big 4 accountancy firm, and holds a degree from Loughborough University.

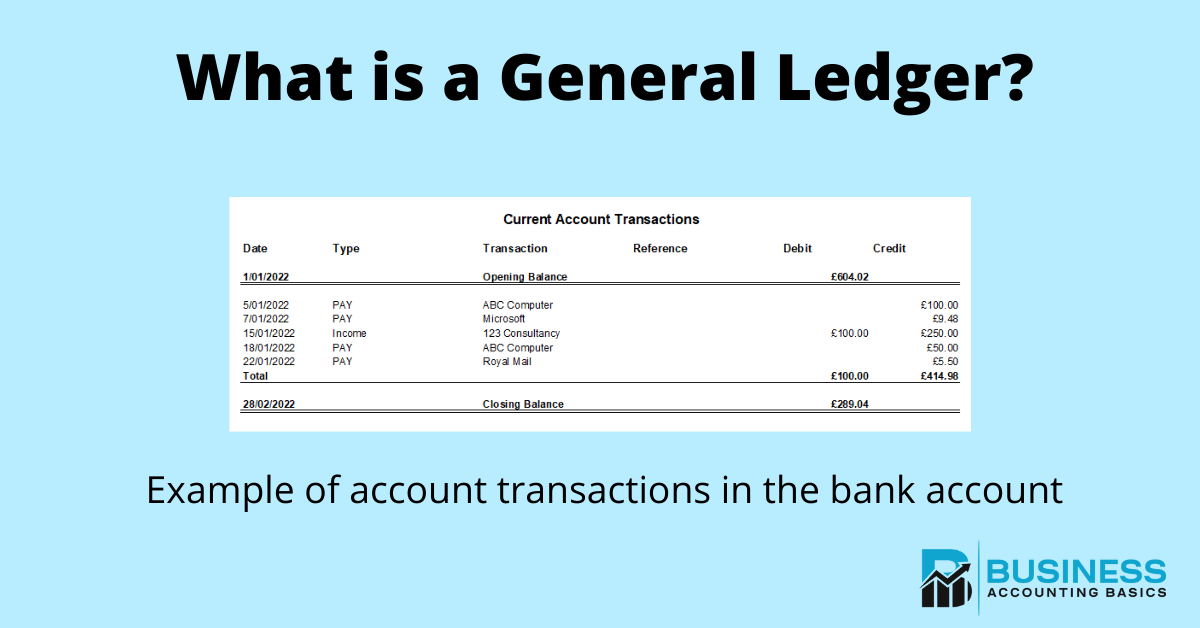

Accounting ledgers can be displayed in many different ways, but the concept is still the same. In the first column, we see the type of account and the type of transactions within the account. It is common to see the number of the transaction if it has been paid by check or entered in for tracking purposes. Software like QuickBooks, SAP, and Oracle are commonly used to manage general ledger accounts and transactions. Non-operating revenue accounts are the money that’s earned by any business outside of main operations. This could be investment income, or money that you earn from selling equipment that you no longer need.

On January 31, you receive a $2,500 payment for completing a project and use the cash to pay off your credit card balance. Immediately, you create the following journal entries to record the month’s transactions. As a result, you and your accounting team will typically consult the general ledger whenever necessary to investigate the details of your business’ activities, transactions, and account balances.

In the past, the general ledger is usually prepared later date after the journal entry was made. All that required are the journal entries to enter into the company’s accounting software. It contains detailed records of all the company’s accounts, including assets, liabilities, equity, revenue, and expenses. Each transaction is interest on a business credit card deductible recorded in the general ledger affects at least two accounts through the double-entry bookkeeping system. Account balances represent the overall value in an account, calculating the debits and credits at any given time.When looking at account balances, you might hear the terms debit balance and credit balance.

This information is used to prepare financial reports, monitor finances, track cash flow, and prevent accounting errors or fraud. A general ledger account is a record within the general ledger that tracks all financial transactions related to a specific aspect of a business. These accounts are fundamental components of the double-entry bookkeeping system, ensuring accurate and balanced financial reporting.

- For each entry in your chart of accounts, it displays a sub-ledger documenting the details of every transaction affecting it, culminating in the account’s running balance.

- This means you first need to record a business transaction in your journal, and remember to record them in the order in which they occur.

- Account balances represent the overall value in an account, calculating the debits and credits at any given time.When looking at account balances, you might hear the terms debit balance and credit balance.

- For a small business the most common way to split the ledger is into four subledgers.

- A general ledger has four primary components, these include a journal entry, a description, debit and credit columns, and a balance.

If yours is inaccurate, you’ll inevitably have issues with your financial statements. Unlike journal where transactions are recorded in chronological order as they occur, you record transactions in the ledger by classifying them under various account heads to which they relate. The assets are categorized into current assets and fixed assets, and are typically reported on the left hand side of your company’s balance sheet. A control account operates the same as general ledger account but you record only the summarized information regarding a specific account. It does not contain detailed information related to such an account, so you need to refer to a related subsidiary ledger in order to get details of such a control account. Having a general ledger may help the audit run smoothly, because you can easily verify information if various accounting items are classified and recorded accurately.

Likewise, revenue and expense accounts give an accurate view of the incomes earned and/or the expenses incurred. You record the financial transactions under separate account heads in your company’s general ledger, so at the end of the accounting period, you close these accounts. You do this as a result of balancing the debit and the credit sides of such accounts. You need to record business transactions in your books of accounts based on the dual aspect of accounting. So, as per the Duality Principle, each transaction will involve a minimum of two accounts, meaning one account will increase while the other decreases.

At the month end the difference between the total debits and credits on each account represents the balance on the account. We discuss the process of balancing the account in our post on balancing off accounts. Having an easy-to-read general overview of your company’s finances and creating trial balances can help you spot unusual activity, or fraud quickly, so you can take action before a serious problem develops. You can also use the information on a GL to verify the accuracy of financial statements during internal reviews and audits. Having an accurate record of all transactions that have taken place within a single point in time will ensure your financial reporting is done correctly.